Personal Loans 2022: See Rates & Apply for Online Loans

Table of Content

- Rent vs. buy: Is buying a better option than renting?

- Diverse business resources

- How To Refinance Your Mortgage With Bad Credit

- Why is it essential to improve the credit score before refinancing?

- How to Change From a Reverse Mortgage to a HELOC

- Raise your credit score to save more on your refinance

- Bankrate logo

The period or length of time you have had your credit is also an important factor. Having a credit for a long time really helps in making your credit score better and leaves a good impression on your loan application. For this reason, you can use the credit card that you have owned for the longest period of time. You can order a free copy of your credit report from Equifax and TransUnion once a year, so that’s the first step in this process. But you have to personally review it because there are often errors on your credit report that can hurt your credit score. Loan approval is subject to credit approval and program guidelines.

Please click here for the full Affiliated Business Arrangement disclosure form. You are not required to use Credible as a condition to obtain access to any settlement services, such as homeowners or other insurance products. If your credit score isn’t high enough to qualify you for the refinance or interest rate you need, you might consider increasing your score before applying. Your lowest score from the credit reporting bureaus is likely going to be used for qualification purposes, Allred explains.

Rent vs. buy: Is buying a better option than renting?

Another component that lenders will look at is your home’s loan-to-value ratio. This is how much you owe on your home divided by your home’s current value. Generally, your LTV ratio should be no higher than 80% if you want to refinance. If you want to know how much youd be paying every month after a refinance, use a handyrefinance payment calculator like the one on Solaritys refinance page. Before you can answer the question of what credit score you need to refinance your home, you should know why you might want to refinance in the first place. On top of that, if the personal loan you repaid was your only installment loan, it might change your credit mix, which could have a negative effect on your credit.

And qualified conforming loan borrowers might get an appraisal waiver from Fannie Mae or Freddie Mac in order to avoid this fee. Before you can request and compare refinance loan offers, you need the right records in hand. Your credit score plays a big role in your ability to qualify for a mortgage, as well as how much it’ll cost you.

Diverse business resources

Keep in mind these are just the minimums set by the Department of Housing and Urban Development. Individual lenders can set score minimums higher than this . You can start by visiting Credible to easily compare mortgage refinance rates in minutes. Mortgage refinance closing costs typically range from 2% to 6% of your loan amount, depending on your loan size. National average closing costs for a refinance are $5,749 including taxes and $3,339 without taxes, according to 2019 data from ClosingCorp, a real estate data and technology firm.

Credit score requirements can vary based on the type of loan you’re taking out, and even the individual lender. Factors such as your loan-to-value ratio, and even the type of home you have, can also change your credit score requirements. Plus, too much new debt makes you a higher-risk borrower in the eyes of mortgage lenders. Wait until after your mortgage refinance is complete before opening new credit accounts. Another government-backed option to explore is refinancing through the FHA.

How To Refinance Your Mortgage With Bad Credit

She practiced real estate law in various “big law” firms before launching a career as a commercial writer. Her work has appeared on numerous property sites including Housemaster, For Rent and Active Rain. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there. An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question. Get transparent rates when you shop for title insurance all in one convenient place.

1) Pay off old debts – if you are paying an interest rate of 15% on a credit card, try to pay it off as fast as possible. The faster you pay it off, the better your credit score will be. Because each person’s situation is different, it’s hard to say how this will affect your credit. If you have a chance to get out of debt and save money on interest charges, you should consider paying off your personal loan. Lenders want to ensure that you’ll be able to repay your loan on time. Before they approve your loan application, they review several factors to determine your credit risk.

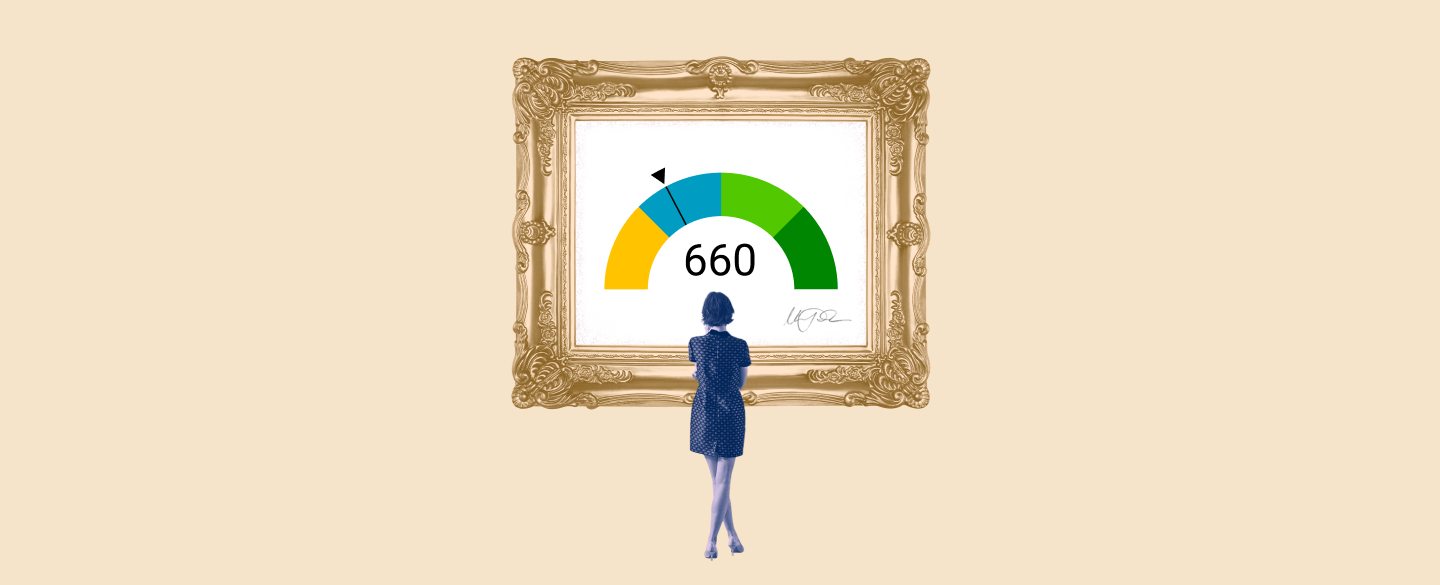

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your LTV ratio is the percentage of your home’s value being financed by your mortgage.

Credible Operations, Inc., (“Credible”) has a business relationship with Young Alfred, Inc., (“Young Alfred”), an insurance broker. You are not required to use Young Alfred as a condition for settlement of your loan. Credible can help you streamline the process by filling out a single form instead of many. The offers that appear on this site are from companies that compensate us.

The VA’s interest rate reduction refinance loan is a streamline refinance program with no credit score requirement for existing VA borrowers. Like the FHA streamline, you won’t need to provide income documentation or pay for an appraisal. You’ll still be responsible for closing costs, including a VA funding fee equal to 0.5% of your loan amount (unless you’re exempt). Like the assist option, a streamline refinance doesn’t require borrowers to have equity in their home. Additionally, there’s no minimum credit score required by the USDA—though keep in mind that the lenders who provide these loans often require a score of at least 640. You must also have made your required payments for the six months before your application.

You will also need to meet the VA’s military service requirements for these loans. Lenders that offer these loans might require a higher credit score to lessen the risk. VA refinance loans don’t have a set minimum credit score requirement. Other personal factors — such as your new loan’s LTV ratio, your payment history, and your debt-to-income ratio — may require you to have a higher credit score in order to qualify.

The cut-off for refinancing is about 620—really considered a poor score and not bad, which is 600 or less. Another critical factor is to keep all credit debt payments up to date. And here, too, it is crucial to remember that the credit card is a valued factor in the credit score. You may think that only the payments on your loans influence your situation, but that is not correct. Regardless of current loan type, anyone can refinance into an FHA loan.

Comments

Post a Comment